Scalping is a form of very short term trading that skims small profits at a high frequency, when we trade FESX by his nature, it not allow to enter many times, its more quiet with clean moves and i think perfect to start testing our strategy, if somedays i dont see any good opportunity with FESX I will try to trade 6E that move faster.

Definitions:

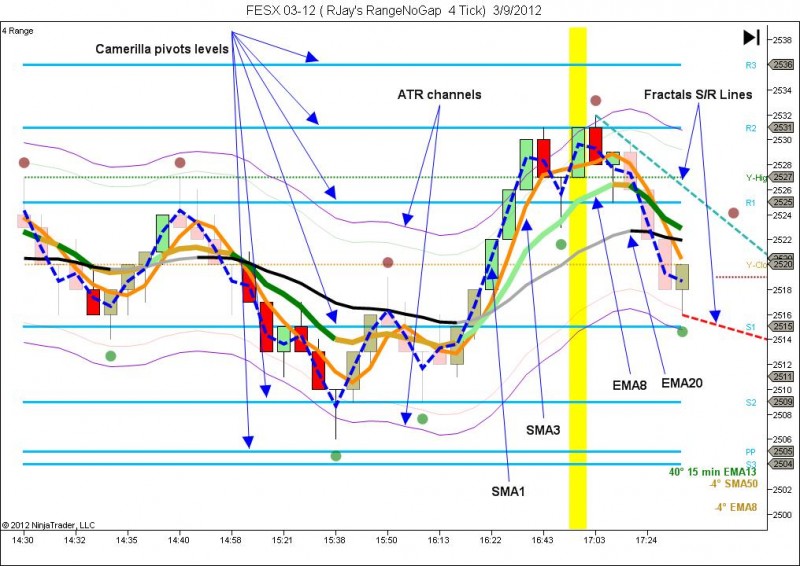

Range bars: it just look price, the bar does not close at a specific time but closes when a range is complete.

We use Range bars without gaps, if price move suddently 2 or more ticks, it paint always consecutive ticks

SMA = Simple Moving Average (Typical High+Low+Close/3)

EMA = Exponential Movil Average

Instruments:

We will trade FESX (EURO STOXX 50 Index Futures) Futures and 6E (EuroUSD) Futures, but this system can be applied to any 6A, 6C, 6S, GC, SI, CL, TF, etc. with the appropiate timeframe depending of the volatility of the instrument.

Euro Stoxx 50 is an index that represents the Supersector leaders in the Eurozone. The companies of Euro stoxx are: Air Liquide, Alcatel-Lucent, Allianz, Anheuser-Busch_InBev, ArcelorMittal, Assicurazioni Generali, AXA, Banco Santander, BASF, Bayer, BBVA, BNP Paribas, Carrefour, Daimler AG, Deutsche Bank, Deutsche Börse, Deutsche Telekom, E.ON, Enel, Eni, Fortis, France Télécom, GDF Suez, Groupe Danone, Iberdrola, Inditex, ING Group, Intesa Sanpaolo, L’Oréal, LVMH, Munich Re, Nokia, Philips, Renault, Repsol YPF, RWE, Saint-Gobain, Sanofi, SAP AG, Schneider Electric, Siemens, Société Générale, Telecom Italia, Telefónica, Total S.A., UniCredit, Unilever, Vinci, Vivendi, Volkswagen Group

Timeframes:

FESX: 4 ticks range (without gaps)

6E: 5 ticks range (without gaps)

Conditions:

- EMA8 slope > 15

- Slope of the Divergence between EMA8 and EMA20 >=0

- SMA1 slope>5 in the direction of the trade

- SMA3 slope>5 in the direction of the trade

- Bar touching 8EMA is the signal and entry bar

Its Very important don’t trade against specifically the SMA3 Typical

High time frame: 15 range (not shown):

- SMA1 slope>5 in the direccion of the trade

- Color candle in the direction of the trade, for long position should be a green bar and for short should be red

Optional confirmation indicators

- Camerilla pivots, its a range of Support and Resistance levels where prices was moving last day.

- Fractals Lines, calculated dynamic support and resistance lines based on high/low fractals points

- ATR channels bands creates target bands, for estimation of different price targets. Its based on ATR which reflects instrument volatility

Times to trade

London and US market open

8.30 to 11.30 and 14.30 to 17.30

Take Profit and Stop Loss

- TP: 4 ticks

- SL: 4 – 5 ticks or when SMA1 cross SMA3

The High time frame of Range 15 condition to avoid more distraction its included already and condition is satisfied when bar turn color to red or green chaging contrast.

EuroStoxx 50 (FESX) Summary Contract Specifications

The contract is traded on the Eurex.

- Unit of trading : 10

- Contract size : EUR 10 x the level of the Eurostoxx-index

- Delivery months : March, June, September and December

- Quotation : In points (each full point = EUR 10 per contract)

- Minimum price movement : 1 point (= EUR 10 per contract)(tick size and value)

Trading example

- The value of the Eurostoxx futures is 2.494 x 10 € = 24.940 €.

- Buy 3 contracts at 2.494 and sell at 2.500.

- The minimum price movement of ‘tick’ is 1 point.

- The tickvalue or 1 point is 10 €

When the Eurostoxx index goes from 2.494 to 2500 or 6 point, a profit of 6 points x 10 x 3 contracts = 180 € is realized.

Euro FX (6E) Summary Contract Specifications

The contract is traded on CME futures market.

- Unit of trading : 125.000

- Contract size : 125.000 x EUR/USD

- Delivery months : March, June, September and December)

- Quotation : In points (each full point = USD 125.000 per contract)

- Minimum price movement : 0,0001 points (= USD 12,50 per contract)

Trading example

- Buy at 1,3113 and sell at 1,4513.

- The value of the futures contract is 125.000 x 1,3113 = 163.912,5 $

- The minimum price movement of ‘tick’ is 0,0001 point.

- The tickvalue or 0,0001 points is 12,5 $

- 10 ticks x 12,5 $ = 125 $

When the EUR/USD goes from 1,3113 to 1,3123 a profit of 125 $ is realized

Sunday, December 9th 2012 at 3:04 am |

Hi! Are you selling your mjosescalper NT automated strategy? I am interested in trying it out.

Thanks!