MjoseScalper version 0.1 futures automated system has been created

This weekend i have created my first version of MjoseScalper automated system, I dont need to stay all the day in front of the computer with bloody eyes seeing a boring chart and waiting indicators give me the signal!!!!!!!!!!!!!!

The bad news is that i can not backtest this bot with Ninjatrader because Ninjatrader can not backtest with ticks or using intrabar orders, all orders are completed at the close of the bar. So I will need to test in realtime to see intrabar orders with Ninjatrader.

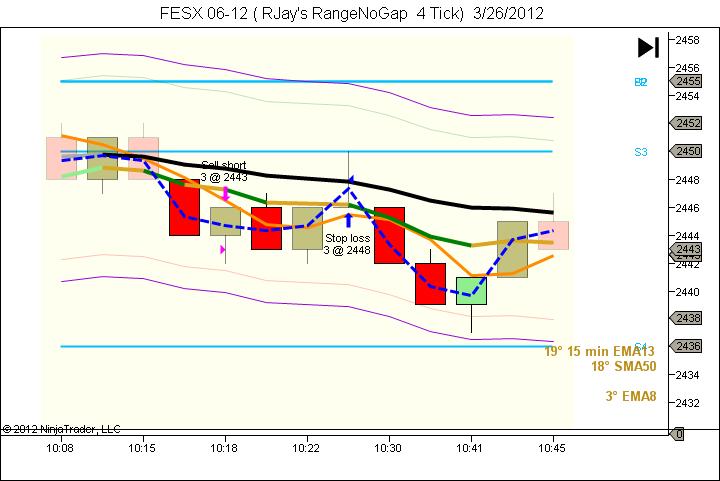

I tested today but it was not running all day, I have 1 negative trade and another positive, first thing i would like to see testing using this bot is to study if it will be better to wait until bar close or enter the intrabars trades. The first version of the bot use only ATR bands as confirmation to enter the trade and price to enter should 3 ticks before the ATR band to be in the range of prices and to have more probabilities.

First trade was negative, if this time i wait until bar close, this trade was not done at 10.18, but it at 10.30 trade when bar is closed and it could be a winner trade, but was not ejecuted because i stopped the bot, i have to leave out.

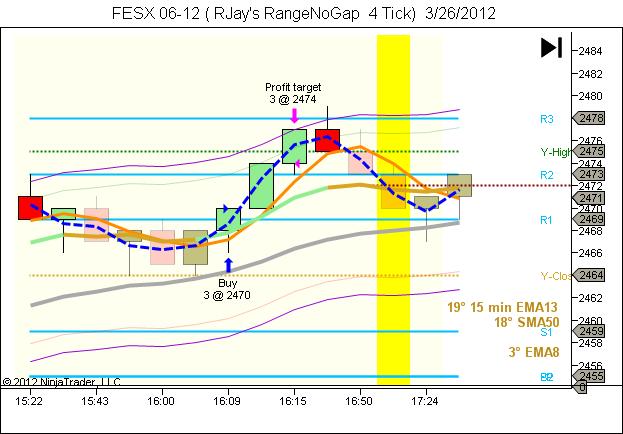

This trade was entered at the time bar was closed and was a winner trade.

Tuesday, March 27th 2012 at 5:44 pm |

Hi!

Why do you think that your current system is working, since you couldn’t really back test it?

Where did you get the idea for this system?

Since you are a automated system trader, do you also trade and practice discretionary?

How does your work flow look like? Do look on a chart and recognize a possible system, or do you first program and and and…?

Lots of simple questions. Don’t get bored. 🙂

Good trades,

mci

Tuesday, March 27th 2012 at 6:28 pm |

I have tested for some months, i got this idea from some forums where people already was testing from many time too.

I practice discrectionary trading but only to learn to know how work the system and to know the way to filter looser trades.

After 1 month practicing and making my journal i think i am ready to start to design and program my own automatic system.

Today i have added a new filter, an ADX trend strength filter, to avoid trades in a choppy market

At the moment i am testing in real time, but once i see if after real time testing can i see it works better with bar close prices then i can backtest and see performance in the past. If i will need to do intrabar trades i will have to move to multicharts platform that allow backtest with intrabar granulity.

Tuesday, March 27th 2012 at 9:07 pm |

mjose,

thanks for the great answer and your inside thoughts!

It’s always good to understand the work procedure.

Good trades,

mci