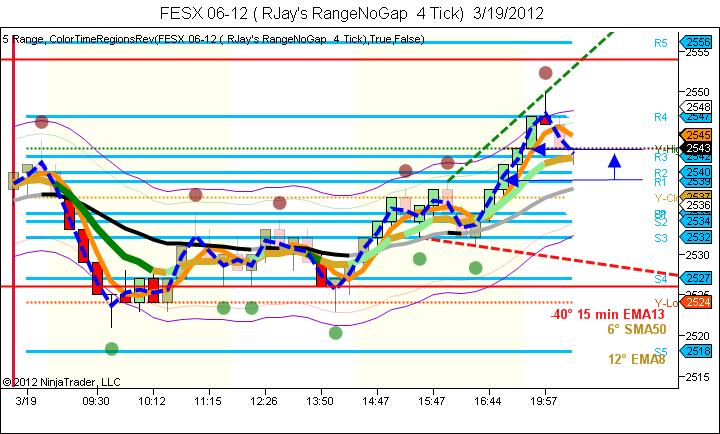

I got promising results of MjoseScalper, yesterday i have not posted any trades because i was working with optimization and backtesting of FESX, After i got this results I stopped my discretional trading, now i will let the bot run in Simulation mode for sometime and if everything looks good, i will try with a live account. I dont used hour filter.

I have optimized only the Stop Loss of MjoseScalper, i increaed from 4 ticks to 8 ticks, to get better results, after i backtested during last year, this is the results:

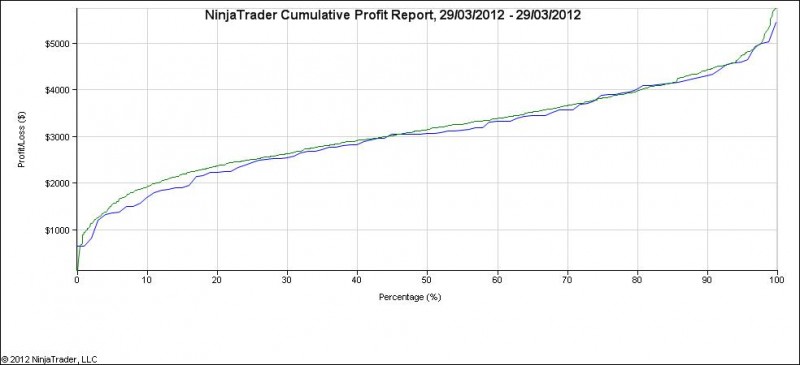

Cumulative profit report:

| Performance | All Trades | Long Trades | Short Trades |

| Total Net Profit |

$3190,00 | $1730,00 | $1460,00 |

| Gross Profit | $10230,00 | $5360,00 | $4870,00 |

| Gross Loss | $-7040,00 | $-3630,00 | $-3410,00 |

| Commission | $0,00 | $0,00 | $0,00 |

| Profit Factor | 1,45 | 1,48 | 1,43 |

| Cumulative Profit |

$3190,00 | $1730,00 | $1460,00 |

| Max. Drawdown | $-530,00 | $-390,00 | $-530,00 |

| Sharpe Ratio | 0,54 | 0,46 | 0,56 |

| Start Date | 01/01/2011 | ||

| End Date | 28/03/2012 | ||

| Total # of Trades |

351 | 186 | 165 |

| Percent Profitable |

73,22% | 72,58% | 73,94% |

| # of Winning Trades |

257 | 135 | 122 |

| # of Losing Trades |

94 | 51 | 43 |

| Average Trade | $9,09 | $9,30 | $8,85 |

| Average Winning Trade |

$39,81 | $39,70 | $39,92 |

| Average Losing Trade |

$-74,89 | $-71,18 | $-79,30 |

| Ratio avg. Win / avg. Loss |

0,53 | 0,56 | 0,50 |

| Max. conseq. Winners |

36 | 25 | 15 |

| Max. conseq. Losers |

4 | 4 | 4 |

| Largest Winning Trade |

$40,00 | $40,00 | $40,00 |

| Largest Losing Trade |

$-80,00 | $-80,00 | $-80,00 |

| # of Trades per Day |

0,95 | 0,51 | 0,45 |

| Avg. Time in Market |

16,6 min | 20,4 min | 12,3 min |

| Avg. Bars in Trade |

2,7 | 2,8 | 2,6 |

| Profit per Month |

$264,39 | $144,17 | $121,01 |

| Max. Time to Recover |

123,06 days | 155,04 days | 183,85 days |

| Average MAE | $34,79 | $35,43 | $34,06 |

| Average MFE | $35,13 | $35,38 | $34,85 |

| Average ETD | $26,04 | $26,08 | $26,00 |

I passed Montecarlo simulation for the Cumulative profit and Drawdown:

Read the remainder of this entry »