How is Manuel Gallego as a person?

How is Manuel Gallego as a person?

I am a restless person , and I like to always mark me new goals , but at the same time trying to balance my work allows me to have a certain quality of life and geographical independence. To get it , 10 years ago I leave my job as a programmer in the university of cordoba, Spain, it allowed me to work anywhere in the world with my laptop and also have the freedom to decide how , where and when to work

How is your way of being and thinking the markets?

Study the markets from the technical point of view , and the way I operate markets is based on automated systems that have been optimized with several years of historical data backtesting and several months forward testing in real time. At the same time study certain correlations between markets, which can help in certain market conditions to detect trends, this study helps me to know when my system worked and also when to stop.

Being, as you are, a person with your university studies and coming from a totally different business …, Do you think that anyone could make money in the market?

If indeed think anyone could engage in trading, and earn money, do not need special training , but always help if you have some facility with numbers and computer. In my case, i am computer engineer, and in this world of infinite information , strategies, indicators , robots, etc. . I think helped me most is the custom to handle a lot of information and know how to select the appropriate.

What advice would you give to a person who first access to the stock market world?

I would recommend , you should start to discover and know what type of trader is because we each have our own style as according to our preferences. In function of the degree of risk that can withstand the time available to spend , the level of stress that is ready or you want to take , capital, etc. . A first approach could be preferred strategies is whether long or short term. For most people I recommend you use a long-term strategy , and a good one with which I was introduced to this world is the strategy of hispanics turtles (tortugas hispanicas. But whether in strategies for long or short term in any case once you selected a trading system , plan well operations and apply them with discipline at the right time , and keep a journal of all transactions in opinions on the scenario presented and the reasoning that led him to perform each operation.

What would you recommend they never do?

Do not play on the stock market like a gambling casino, but invest in the stock market continues to be a game where we have to have the odds in our favor, which would recommend not to do is to use a strategy that has not been properly verified and tested . For example to select an automated system needs to be designed , with historical test , and optimize it for maximum run limit losses or drawdown , recovery capacity , profitability, mathematical expectation , etc. . Once you have passed the necessary tests , you should use a demo account for a while , which is called paper trading , if the results are satisfactory pass to real mode at low load , and then gradually increasing the load wrath . Also would recommend that never came into intraday trading , and if it decides not to use less than H1 or graphics of hours timeframe , because below that time the markets are almost random and unpredictable .

How do you see the current market? Regarding volatility , volumes , it is generally easy today’s market?

Currently , the markets that I see are the U.S. markets to check the volatility index VIX I check , and by the time this index indicates that there is not much volatility. Volume is something that I have considered in my strategies , because they are based only on price. Generally speaking I think it is not an easy market today’s market.

What would you like to trade and how you like to trade?

I like to negotiate on all silver and gold on the spot market , currencies, futures and Eurostoxx FDAX . Study certain correlations between markets for use as filters sometimes . Try to long-term strategies is not as important , but for short-term strategies I think the best way to operate is through a signaling or automatic system , you indicate either directly execute purchase orders or sales , although we think that we ourselves can determine when to enter or exit , sometimes our minds betray us, and gives us an objective view of the situation, and make us change can not apply the method and discipline for example when there are 2 or more operations lost , surely if we do it manually or evaluating ourselves every time, decide not to enter the third operation and just give us all the benefits we have lost in recent operations.

How has begun to trade and when?

I started trading in 2010. It was with Apple stock. In February 2011 , after doing courses hispanicas turtles. Immediately discovered the existence of automated systems, in March learned to program them using STRATEGY TRADER and MetaTrader4, in April 2011, and had my first automatic signaling system thats warm me when to operate. At the same time implement a system that scanned more than 70,000 market instruments to find and filter who followed a certain pattern , and among them I caught the attention of Canadian silver mines , and thence pass into the spot market dealing mainly silver in forex market.

How is your operational methodology ?

I have several systems right now, will comment that I used during the competition.

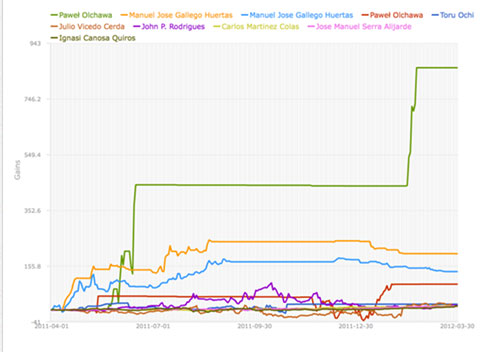

Between April and September , apply my system for silver is based on a system of breaking bands or Donchian bands, I studied during last two years the prices of silver and gold, favored by the policy American monetary expansion ( QE1 and QE2) that ended in June 2011 . This policy clearly describe the background of printing American dollars that makes the US dollar was losing value, this benefited among others commodities to silver and gold .

Furthermore also took into account a correlation between different markets to the price of precious metals to remain in an upward trend.

Since December started using a system for futures using Ninjatrader platform with graphics ranges, based on 4 moving averages with a filter confirmation ATR band , camarilla levels and pivots . But there was no time to make the necessary checks in real time and with a few months to finish the competition did not have time to do tests forwardtest and this system I fail to operate as expected with futures, currently I am working on this system, and the algorithm have made public through this blog mjose.com

Why after you finished the WTI was not active from 2012 until 2014?

After i finished to participate in the WTI in 2012, i left from the stock market, the condition market are not good for my strategy, so i decided to move to Africa to consider to trade real gold instead gold in forex market. I had some references of some friends already importing Gold from Africa, so i decided to invest my earnings investing in gold, i was there several months, first in Gambia (April 2012) and later in Ghana (May to August 2012), and it happened me something terrible, i lost a lots of money, i was scammed for the biggest African Scammer Nana Donkor, you can read an incredible story of gold scam in ghana that happened to me. This broke me, i tried everything as you can read, but this time i lost.

Will you consider to manage an investor fund or PAMM account in the future?

Yes, now i am considering to reenter to the market again, i am open now to accept investors, i think 2014 will be a good year and i see that market conditions now are favorable, i will choose broker depending of my investors preferences, althought we can consider Difbroker or instaforex. My strategy will have limited losses to a maximum of 4% and no limit for earnings, but expected between 20 and 40%.

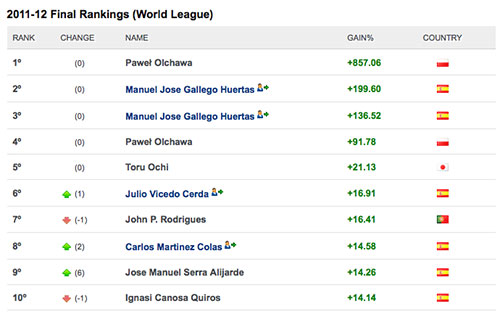

Word Top investor 2011 – 2012

Update Your Analytics Tracking Code to Support Display Advertising wordpress plugins

By mjose | Filed in MarketingRecently Google allow to track at Google Analytics Display Advertising to see demographics and interest of visitors. Althought google removed keywords information from analytics, now this is an interesting and very useful info to help us to make new marketing strategies

You need to do a simple line change at your google analytics Tracking Code:

<script type="text/javascript">// <![CDATA[

var _gaq = _gaq || []; _gaq.push(['_setAccount', 'UA-xxxxx-y']); _gaq.push(['_trackPageview']); (function() { var ga = document.createElement('script');

ga.type = 'text/javascript'; ga.async = true; ga.src = ('https:' == document.location.protocol ? 'https://ssl' : 'http://www') + '.google-analytics.com/ga.js';

var s = document.getElementsByTagName('script')[0]; s.parentNode.insertBefore(ga, s); })();

// ]]></script>

change the line in bold by

<script type="text/javascript">// <![CDATA[

var _gaq = _gaq || []; _gaq.push(['_setAccount', 'UA-xxxxx-y']); _gaq.push(['_trackPageview']); (function() { var ga = document.createElement('script');

ga.src = (‘https:’ == document.location.protocol ? ‘https://’ : ‘http://’) + ‘stats.g.doubleclick.net/dc.js’;

var s = document.getElementsByTagName(‘script’)[0]; s.parentNode.insertBefore(ga, s); })();

// ]]></script>

You can also generate an updated basic code snippet that includes the change by going to Admin > property > Tracking Info, and turning on the Display Advertiser Support option.

If you are using wordpress plugin Google Analytics for WordPress (version 4.3.3)

go directory:

wp-content/plugins/google-analytics-for-wordpress/frontend

Edit file class-frontend.php and change this line number 300 of code:

300 echo “(‘https:’ == document.location.protocol ? ‘https://ssl’ : ‘http://www’) + ‘.google-analytic s.com/” . $script . “‘”;

and changed to:

300 echo “(‘https:’ == document.location.protocol ? ‘https://’ : ‘http://’) + ‘stats.g.doubleclick.net/” . $script . “‘ “;

if you are using simple Simple Google Analytics

Go to directory wp-content/plugins/simple-google-analytics/class

Edit file Output.class.php and change line 142:

142 $ret .= ‘ga.src = (\’https:\’ == document.location.protocol ? \’https://ssl\’ : \’http://www\’) + \’.google-analytics.com/ga.js\’;’ . “\n” ;

change by this:

142 $ret .= ‘(\’https:\’ == document.location.protocol ? \’https://\’ : \’http://\’) + \’stats.g.doubleclick.net/dc.js\’;’ . “\n” ;

Its very simple change but if you need help let me know commenting this post

For the second year in a row, Bloomberg Rankings presents its exclusive analysis of countries around the world based on how attractive they are to business. With its relatively low cost of starting a business, as well as its import and export efficiencies, among other factors, Hong Kong again takes top honors. The U.S. moves up a notch from last year to second place, and Japan jumps from seventh to No. 3.

For this study, Bloomberg Rankings analyzed data from 11 sources. In all, 161 nations were ranked on six broad criteria that included the cost of starting a business, the cost of labor and materials and the cost of moving goods. The study also considered each country’s level of global economic integration, the “readiness” of its consumer base to participate in economic activity and “less tangible” costs such as inflation and accounting adaptability.

Again, the so-called BRIC countries make a relatively poor showing. China drops to 24th place from 19th last year. India, Russia and Brazil don’t even clear the top 50, ranking Nos. 54, 56 and 61, respectively.

Countries are ranked on a scale from 0 to 100 percent on six factors.

1. Degree of economic integration (weighting of 10%)

Includes membership in the World Trade Organization, most-favored nation tariffs, correlation to the global market, market concentration, reach of global market research and country risk.

2. Cost of setting up a business (20%)

Includes the costs, steps and time required, as well as financing a business and foreign direct investment.

3. Cost of labor and material (20%)

Includes cost of labor (productivity, compensation, health expenditures, firing costs, minimum wage and size of labor force) and cost of material (natural resource rate of depletion and natural resource rent).

4. Cost of moving goods (20%)

Includes import and export efficiencies, transportation efficiency, logistics performance, liner shipping connectivity and quality of port infrastructure.

5. Less tangible costs (20%)

Includes corruption perception index, international property rights index, inflation, taxes and accounting adaptability.

6. Readiness of the local consumer base (10%)

Includes size of middle class, household consumption, tariff on imports and GDP per capita.

Scores for individual factors were calculated by using the percentage of the maximum for index-based and qualitative criteria. In the 2011 ranking, scores were calculated on a percent-rank basis.

Sources: Bloomberg, CIA World Factbook, Conference Board, Heritage Foundation, International Monetary Fund, International Labor Organization, Transparency International, United Nations, World Bank, World Health Organization and World Trade Organization.

But this info is not very accurate because by example Spain´s GDP is 30% larger than S.Korea at Nominal prices, for example. Unemployment increased from 9% to 26% during the four years of economic adjustment (not 50%), but precisely now the economy is much more productive. Labor costs have fallen and productivity has increased.

Some Spanish companies are among the biggest and more efficient in the World.

1. Inditex (Zara) is the largest cloth retaling company in the World.

2. Telefonica is the largest and more profitable Telecom company in the Eurozone (larger than Deutsche Telekom).

3. Santander is the largest and more profitable bank in the Eurozone (a third larger than Deutsche Bank)

4. Grupo ACS is the largest construction company in Europe (recently bought Hotchief, the largest construction company in Germany)

5. Acerinox is the largest company in the World in the area of stainless steel.

6. Iberdrola is the largest company in the World in the area of renewables.

7. INDRA is the largest European company in the area of flight simulators.

8. Airbus Military has its headquarters in Spain, which is the third shareholder of AIRBUS…etc, etc.

Public Debt is 10 points lower than the U.S. or the U.K., and already got a trade surplus with the rest of the E.U. Spain enjoys the second High-Speed networkd in the World, and Spanish companies like OHL are building the Saudi Arabian high speed railway, and also Spanish companies are enlarging the Panama Canal.

Spain´s life expectancy is 12 in the World while the U.S. is just 40.

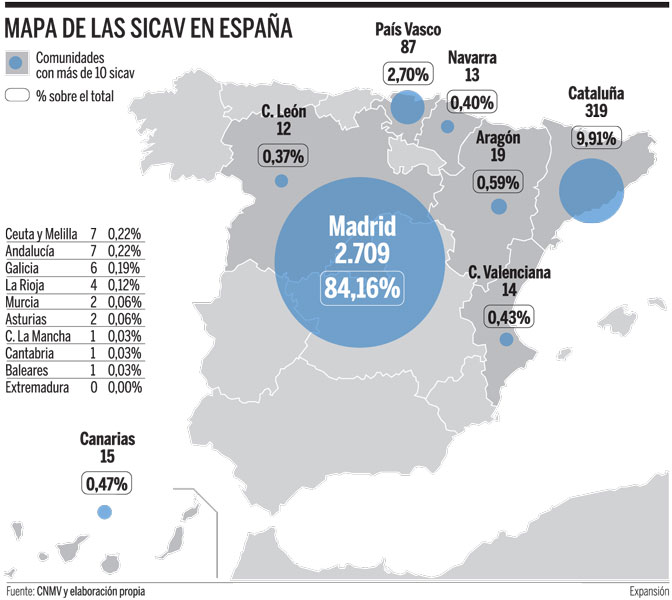

Porque los ricos son mas ricos en España y como se escaquean de pagar impuestos?

By mjose | Filed in Trading JournalLooking for TALENTED ARTICLE WRITER for CLICKBANK/CPA Joint venture

By mjose | Filed in Joint Venture, Marketing Hi guys!, some introduction before we go further. After 10 years of succesful internet business selling consumer electronics reaching PR6 and Alexa 20K, google with his panda and penguin updates kick me from the rank, now i am here almost starting from the begining, with the new rules well learned i decided to try a Joint Venture with someone who can complement me, and what i need is a talent writer, i tried bid job sites but quality is very important and only a good partner can be motivated to write quality content, what topics, how to write it efectively.

Hi guys!, some introduction before we go further. After 10 years of succesful internet business selling consumer electronics reaching PR6 and Alexa 20K, google with his panda and penguin updates kick me from the rank, now i am here almost starting from the begining, with the new rules well learned i decided to try a Joint Venture with someone who can complement me, and what i need is a talent writer, i tried bid job sites but quality is very important and only a good partner can be motivated to write quality content, what topics, how to write it efectively.

Thats why im starting this jv. For starting Im planning to make around 10 website promoting clickbank or CPA Travel, Technology (Consumer electronics) or Food (Gourmet) niches

What i will do?

- I will do a keyword research

- Handle the link building, targetting visitor mostly from the search engine.

- Take care all the cost for the link building, servers, seo tools,

- Invest for domain and hosting.

We will create a mini sites with 40-50 articles on each site targetting around 10-15 keyword depends on the niche.

I would like to JV with some TALENTED ARTICLE WRITERS with such criteria:

- Know how to write article for product review, press release, general article with friendly, professional tone etc ,optimized for the search engine

- Know how to do a product research for the article

- Know how to setup a basic wordpress site

What you will do?

- Update the site content frequently, 2-3 articles/week/site

- Provide original article, rewrite and manual spun article for tier1/2 link building

- Setup a new clickbank/CPA account only for this project with your name and address for the payee name to accept the payment and i will check those account weekly. We use use the account on the site and we split the profit 50-50

Risk

- You will have the full control for the domain and hosting, using your own clickbank account on the site, no money need to sent to me, so no risk for me to scam your money

- We will create 2 different domains by niche, 1 will be registered by you and the another by me

- If youre not satisfied with the result and decided to stop our jv, i will buy the site from you with price we agreed for, or selling the site on flippa and split the profit 50-50 or i will decided to let you own the domain

All my partners including me are not allowed to collect visitor email or setup a fan page on the site.

You can choose how much site you want to handle. 1 or 10 depend on you.

I’m open to negotiations and will accept reasonable terms.

Contact me if you’re interested.

Only looking for ONE partner. The guy with the best tried and tested idea will be prioritized.

You can be a newbie or a seasoned pro. It all depends on your method.

- Hi! I consider this a very interesting proposition. I am an experienced writer in Spanish language and I have a…

MjoseScalper FESX (eurostoxx 50) one year Backtest 351 trades 73% profitable

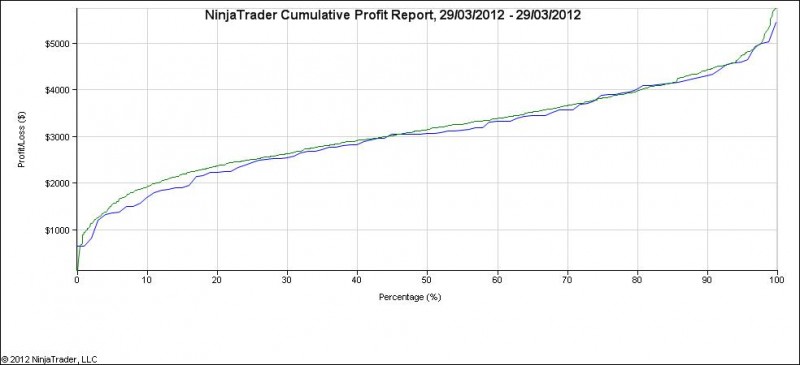

By mjose | Filed in Trading JournalI got promising results of MjoseScalper, yesterday i have not posted any trades because i was working with optimization and backtesting of FESX, After i got this results I stopped my discretional trading, now i will let the bot run in Simulation mode for sometime and if everything looks good, i will try with a live account. I dont used hour filter.

I have optimized only the Stop Loss of MjoseScalper, i increaed from 4 ticks to 8 ticks, to get better results, after i backtested during last year, this is the results:

Cumulative profit report:

| Performance | All Trades | Long Trades | Short Trades |

| Total Net Profit |

$3190,00 | $1730,00 | $1460,00 |

| Gross Profit | $10230,00 | $5360,00 | $4870,00 |

| Gross Loss | $-7040,00 | $-3630,00 | $-3410,00 |

| Commission | $0,00 | $0,00 | $0,00 |

| Profit Factor | 1,45 | 1,48 | 1,43 |

| Cumulative Profit |

$3190,00 | $1730,00 | $1460,00 |

| Max. Drawdown | $-530,00 | $-390,00 | $-530,00 |

| Sharpe Ratio | 0,54 | 0,46 | 0,56 |

| Start Date | 01/01/2011 | ||

| End Date | 28/03/2012 | ||

| Total # of Trades |

351 | 186 | 165 |

| Percent Profitable |

73,22% | 72,58% | 73,94% |

| # of Winning Trades |

257 | 135 | 122 |

| # of Losing Trades |

94 | 51 | 43 |

| Average Trade | $9,09 | $9,30 | $8,85 |

| Average Winning Trade |

$39,81 | $39,70 | $39,92 |

| Average Losing Trade |

$-74,89 | $-71,18 | $-79,30 |

| Ratio avg. Win / avg. Loss |

0,53 | 0,56 | 0,50 |

| Max. conseq. Winners |

36 | 25 | 15 |

| Max. conseq. Losers |

4 | 4 | 4 |

| Largest Winning Trade |

$40,00 | $40,00 | $40,00 |

| Largest Losing Trade |

$-80,00 | $-80,00 | $-80,00 |

| # of Trades per Day |

0,95 | 0,51 | 0,45 |

| Avg. Time in Market |

16,6 min | 20,4 min | 12,3 min |

| Avg. Bars in Trade |

2,7 | 2,8 | 2,6 |

| Profit per Month |

$264,39 | $144,17 | $121,01 |

| Max. Time to Recover |

123,06 days | 155,04 days | 183,85 days |

| Average MAE | $34,79 | $35,43 | $34,06 |

| Average MFE | $35,13 | $35,38 | $34,85 |

| Average ETD | $26,04 | $26,08 | $26,00 |

I passed Montecarlo simulation for the Cumulative profit and Drawdown:

Choppy market with many spikes, 6 trades today, 2 positive and 4 negative

By mjose | Filed in Trading JournalWe are getting more negative trades now because we are entering in trades before bar close, i am testing this system to know if it will be better entering trades after bar close or taking intrabar trades, i have added an ADX filter to MjoseScalper from tomorrow we will use an ADX trend strength filter to avoid trades when we are in a choppy market.

- Hello, how is it going? Still trying to implement the automated trading system? I also use NinjaTrader and I wonder…

MjoseScalper version 0.1 futures automated system has been created

By mjose | Filed in Trading JournalThis weekend i have created my first version of MjoseScalper automated system, I dont need to stay all the day in front of the computer with bloody eyes seeing a boring chart and waiting indicators give me the signal!!!!!!!!!!!!!!

The bad news is that i can not backtest this bot with Ninjatrader because Ninjatrader can not backtest with ticks or using intrabar orders, all orders are completed at the close of the bar. So I will need to test in realtime to see intrabar orders with Ninjatrader.

I tested today but it was not running all day, I have 1 negative trade and another positive, first thing i would like to see testing using this bot is to study if it will be better to wait until bar close or enter the intrabars trades. The first version of the bot use only ATR bands as confirmation to enter the trade and price to enter should 3 ticks before the ATR band to be in the range of prices and to have more probabilities.

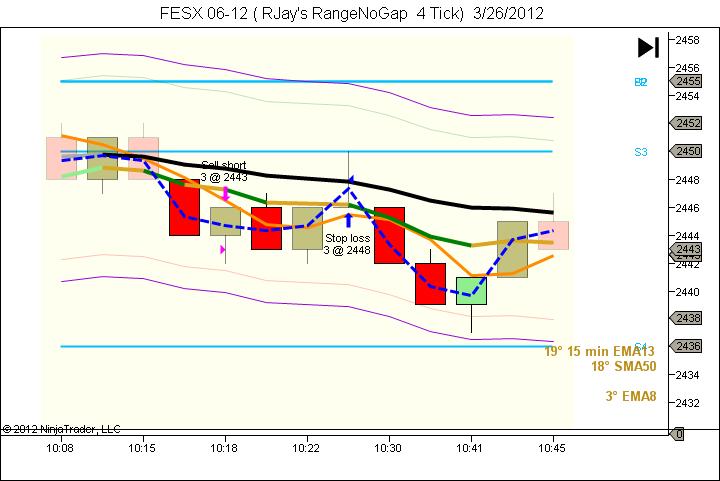

First trade was negative, if this time i wait until bar close, this trade was not done at 10.18, but it at 10.30 trade when bar is closed and it could be a winner trade, but was not ejecuted because i stopped the bot, i have to leave out.

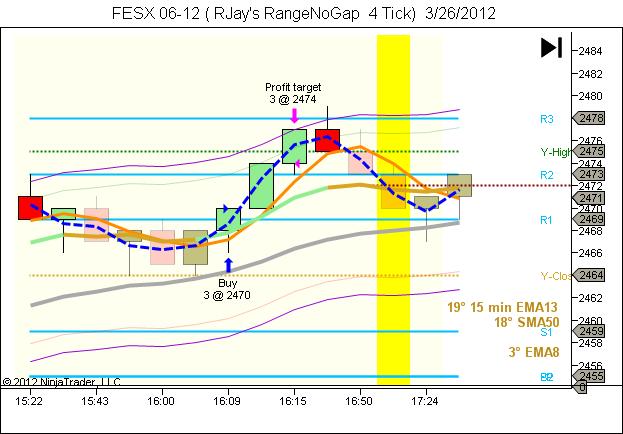

This trade was entered at the time bar was closed and was a winner trade.

- mjose, thanks for the great answer and your inside thoughts! It's always good to understand the work procedure. Good trades,…

- I have tested for some months, i got this idea from some forums where people already was testing from many…

- Hi! Why do you think that your current system is working, since you couldn't really back test it? Where did…

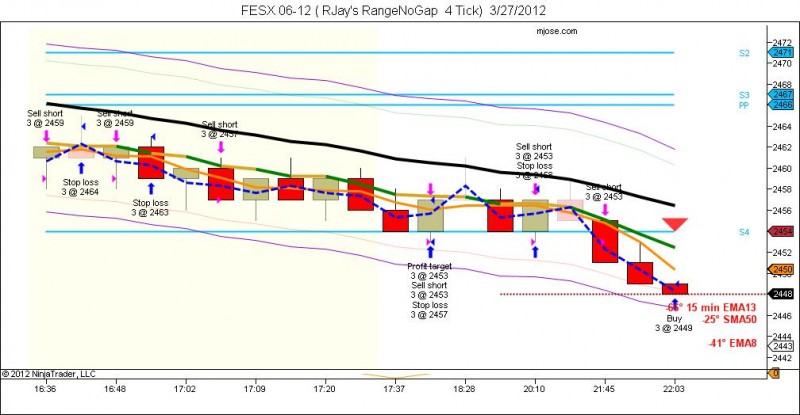

FESX 3 trades one by error -1 tick, two correct trades -4 ticks +3 ticks = -2 ticks

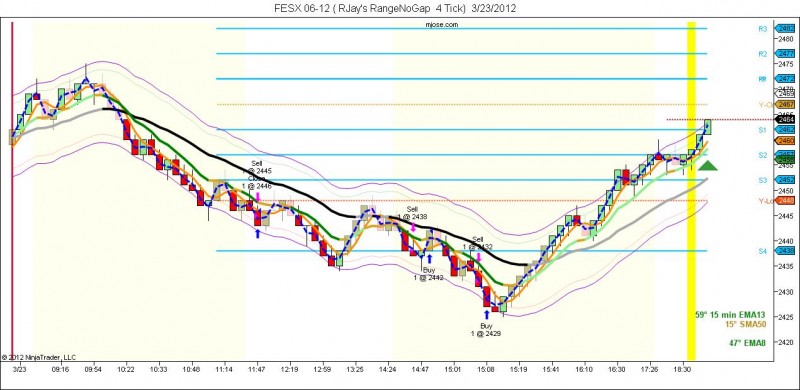

By mjose | Filed in Trading JournalFrom last 3 months there is no more than 3 days with downtrend, so today should be a day where price should go up, however this have not happened until 15.00 PM, and the day finished almost at same price that was open.

I had 3 trades today, first trade was by error because i opened position out of my trading hours, later 11.30, at 11.45 aproximately, when i noticed that inmediately closed position and i got -1 tick negative. If i had not close my position inmediately i was loose 4 ticks instead only 1.

My second trade, as you can see in the picture below, all conditions were good to enter the trade, so i enter short 2438 at 14.41 PM with TP at 2434 and SL at 2442, but in few minutes prices reached my TP but my order was not filled, and 3 minutes later my Stop loss was reached. This happen only 10% of the times, perhaps i should increase stop loss a little.

Before third trade at 15.00 aprox. i have another opportunity, but i was distracted thinking whats going on with my last looser trade, we are not machines, after i recovered my attention to the chart, i entered in my third trade of the day short again at 2432 with TP 2429 and SL 2436 and i got +3 ticks.