How is Manuel Gallego as a person?

How is Manuel Gallego as a person?

I am a restless person , and I like to always mark me new goals , but at the same time trying to balance my work allows me to have a certain quality of life and geographical independence. To get it , 10 years ago I leave my job as a programmer in the university of cordoba, Spain, it allowed me to work anywhere in the world with my laptop and also have the freedom to decide how , where and when to work

How is your way of being and thinking the markets?

Study the markets from the technical point of view , and the way I operate markets is based on automated systems that have been optimized with several years of historical data backtesting and several months forward testing in real time. At the same time study certain correlations between markets, which can help in certain market conditions to detect trends, this study helps me to know when my system worked and also when to stop.

Being, as you are, a person with your university studies and coming from a totally different business …, Do you think that anyone could make money in the market?

If indeed think anyone could engage in trading, and earn money, do not need special training , but always help if you have some facility with numbers and computer. In my case, i am computer engineer, and in this world of infinite information , strategies, indicators , robots, etc. . I think helped me most is the custom to handle a lot of information and know how to select the appropriate.

What advice would you give to a person who first access to the stock market world?

I would recommend , you should start to discover and know what type of trader is because we each have our own style as according to our preferences. In function of the degree of risk that can withstand the time available to spend , the level of stress that is ready or you want to take , capital, etc. . A first approach could be preferred strategies is whether long or short term. For most people I recommend you use a long-term strategy , and a good one with which I was introduced to this world is the strategy of hispanics turtles (tortugas hispanicas. But whether in strategies for long or short term in any case once you selected a trading system , plan well operations and apply them with discipline at the right time , and keep a journal of all transactions in opinions on the scenario presented and the reasoning that led him to perform each operation.

What would you recommend they never do?

Do not play on the stock market like a gambling casino, but invest in the stock market continues to be a game where we have to have the odds in our favor, which would recommend not to do is to use a strategy that has not been properly verified and tested . For example to select an automated system needs to be designed , with historical test , and optimize it for maximum run limit losses or drawdown , recovery capacity , profitability, mathematical expectation , etc. . Once you have passed the necessary tests , you should use a demo account for a while , which is called paper trading , if the results are satisfactory pass to real mode at low load , and then gradually increasing the load wrath . Also would recommend that never came into intraday trading , and if it decides not to use less than H1 or graphics of hours timeframe , because below that time the markets are almost random and unpredictable .

How do you see the current market? Regarding volatility , volumes , it is generally easy today’s market?

Currently , the markets that I see are the U.S. markets to check the volatility index VIX I check , and by the time this index indicates that there is not much volatility. Volume is something that I have considered in my strategies , because they are based only on price. Generally speaking I think it is not an easy market today’s market.

What would you like to trade and how you like to trade?

I like to negotiate on all silver and gold on the spot market , currencies, futures and Eurostoxx FDAX . Study certain correlations between markets for use as filters sometimes . Try to long-term strategies is not as important , but for short-term strategies I think the best way to operate is through a signaling or automatic system , you indicate either directly execute purchase orders or sales , although we think that we ourselves can determine when to enter or exit , sometimes our minds betray us, and gives us an objective view of the situation, and make us change can not apply the method and discipline for example when there are 2 or more operations lost , surely if we do it manually or evaluating ourselves every time, decide not to enter the third operation and just give us all the benefits we have lost in recent operations.

How has begun to trade and when?

I started trading in 2010. It was with Apple stock. In February 2011 , after doing courses hispanicas turtles. Immediately discovered the existence of automated systems, in March learned to program them using STRATEGY TRADER and MetaTrader4, in April 2011, and had my first automatic signaling system thats warm me when to operate. At the same time implement a system that scanned more than 70,000 market instruments to find and filter who followed a certain pattern , and among them I caught the attention of Canadian silver mines , and thence pass into the spot market dealing mainly silver in forex market.

How is your operational methodology ?

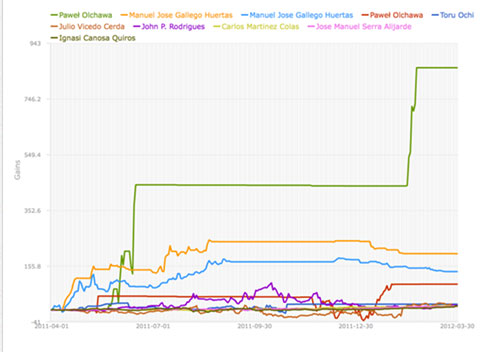

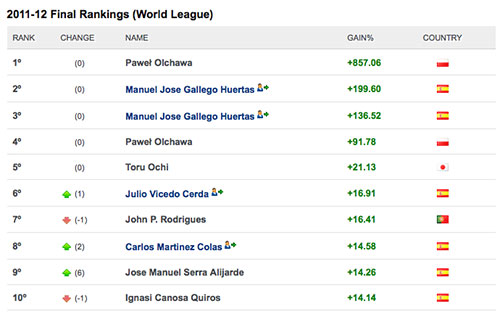

I have several systems right now, will comment that I used during the competition.

Between April and September , apply my system for silver is based on a system of breaking bands or Donchian bands, I studied during last two years the prices of silver and gold, favored by the policy American monetary expansion ( QE1 and QE2) that ended in June 2011 . This policy clearly describe the background of printing American dollars that makes the US dollar was losing value, this benefited among others commodities to silver and gold .

Furthermore also took into account a correlation between different markets to the price of precious metals to remain in an upward trend.

Since December started using a system for futures using Ninjatrader platform with graphics ranges, based on 4 moving averages with a filter confirmation ATR band , camarilla levels and pivots . But there was no time to make the necessary checks in real time and with a few months to finish the competition did not have time to do tests forwardtest and this system I fail to operate as expected with futures, currently I am working on this system, and the algorithm have made public through this blog mjose.com

Why after you finished the WTI was not active from 2012 until 2014?

After i finished to participate in the WTI in 2012, i left from the stock market, the condition market are not good for my strategy, so i decided to move to Africa to consider to trade real gold instead gold in forex market. I had some references of some friends already importing Gold from Africa, so i decided to invest my earnings investing in gold, i was there several months, first in Gambia (April 2012) and later in Ghana (May to August 2012), and it happened me something terrible, i lost a lots of money, i was scammed for the biggest African Scammer Nana Donkor, you can read an incredible story of gold scam in ghana that happened to me. This broke me, i tried everything as you can read, but this time i lost.

Will you consider to manage an investor fund or PAMM account in the future?

Yes, now i am considering to reenter to the market again, i am open now to accept investors, i think 2014 will be a good year and i see that market conditions now are favorable, i will choose broker depending of my investors preferences, althought we can consider Difbroker or instaforex. My strategy will have limited losses to a maximum of 4% and no limit for earnings, but expected between 20 and 40%.