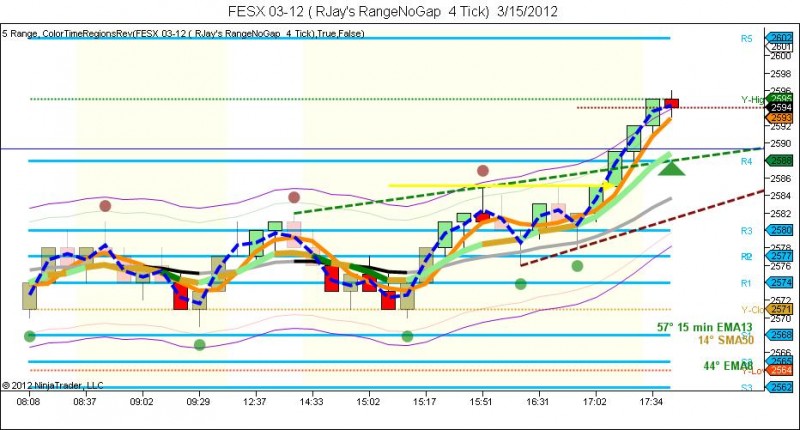

From 9.00 AM we have some other opportunities but ATR was too close, perhaps you can find more secure to enter at 9.00 or 9.30 where looks a good downtrend but nobody cant know how many time price could continue with downtrend, but what we know is the highest probabilities to enter safely and have at least 4 ticks positives at trades 1 y 2.

FESX short 2460 +4 ticks short 2455 +4 ticks = total +8 ticks positive

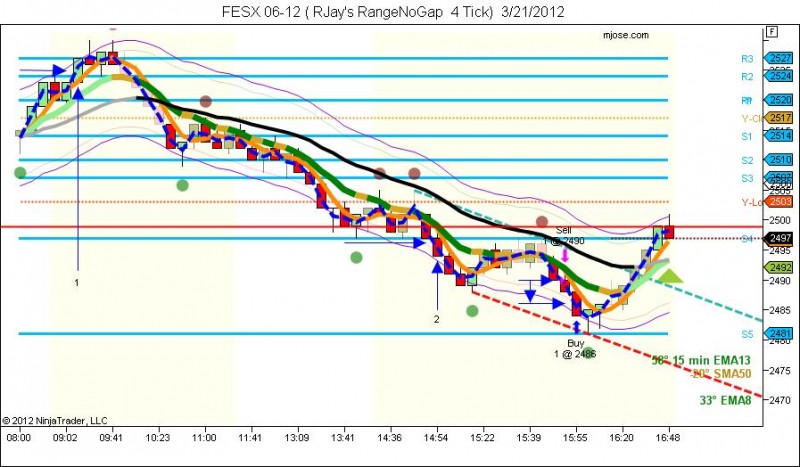

By mjose | Filed in Trading JournalFESX short 2490 +4 ticks positive at 15.50 PM in 5 minutes

By mjose | Filed in Trading JournalI had two more opportunities at 9:05 AM and 14:54 PM but in both cases price was very near from ATR bands and prefer to avoid this trades with less probabilities, anyway it was winner trades too. At 15.50 PM i have good conditions to enter with sufficient space upto ATR bands

6E short 1.3222 -10 ticks negative double bottom and temporally up, EMA20 flat

By mjose | Filed in Trading JournalTrend suddently stopped and a lateral move makes me loose this trade, EMA20 was starting to loose its slope, i cant know it will be a double bottom, so this situation belong to the 10% of probabilities to loose using this strategy.

One hour later, At 15.55 PM have the opportunity to enter again although EMA8 was not touching the candle, but it was my lunch time.

Good EMA8 and EMA20 angles, candle touching EMA8 and S4 support was crossed.

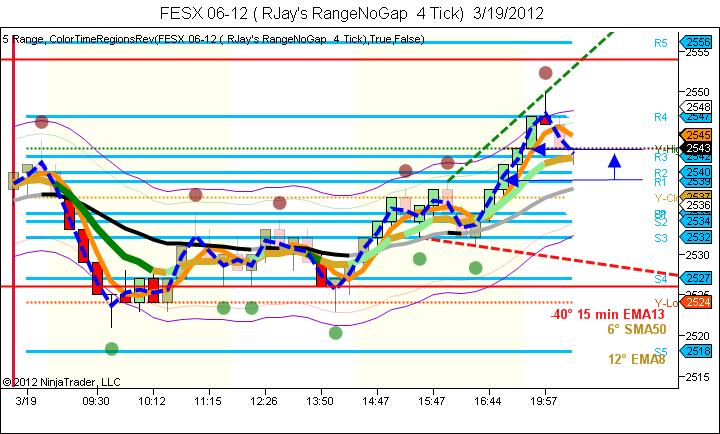

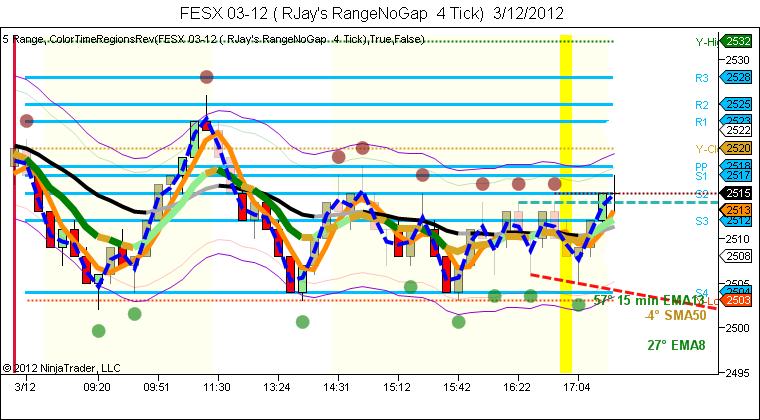

In the morning i prefered dont risk me to enter before S2 was crossed because it was ranging last day in this zone, but when S2 was crossed it was too late to enter because EMA8 was too far, later it was ranging and EMA8 was flat until US open, at 17h. i enter long at 2539, R1 was not still clearly passed but i decided to enter because i have still space upto ATR bands.

- A fantastic strategy trading. You remenber "less is more" Mies Van der Rohe.

At 9:31 AM we have another opportunity but, checked that Euro futures was falling very fast and it will make eurostoxx fall too and i avoid that trade. This is the difference between discretional trading and automated systems, sometimes we use our intuition, or any other instruments information when we have doubts when trend is not very strong.

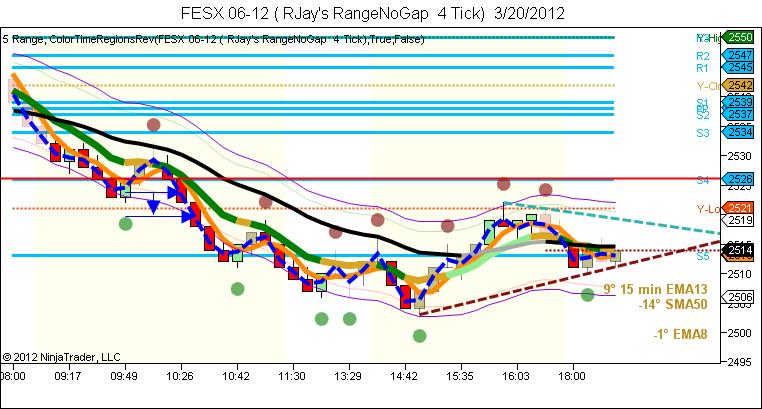

FESX no trades chopping day and 1 trade missed in the US session

By mjose | Filed in Trading JournalAlmost all day was chopping, from 15.51 candle was all an appropiate moment to enter except because it ATR bands was being touched already and i am not sure we was leaving from the choppy market still, so i prefer to wait to the next wave, next signal come at 17.08 candle, but i missed that trade because i prefer to open positions always a tick before and when it was at 2586 i put a my buy limit at 2585 where the its the yellow arrow, but order was not filled and i missed that trade.

In the morning i have another opportunity to enter at 9.30 but i prefer to wait until reach R1, in the afternoon i got another 4 ticks under perfect conditions too. After that and reach my daily limit of 8 ticks i prefer to leave from the market.

I saved the video of my last trade in my new youtube channel:

- I will do at same times as FESX London Open and US open sessions. I dont need to use level2…

- And why do use a 4 tick chart for the FESX? Did you try any other? Sry, lots of questions...…

- Yes I understand. Do you want to trade ES during regular trading hours, or also off hours? For the EUREX,…

FESX 2543 long +4 ticks but i should wait to pass R5 resistance to have more probabilities

By mjose | Filed in Trading JournalIt was very near from my stop at 2439, it was choppy from the morning, it think i should be wait until it had passed the R5 resistance, but finally i got 4 ticks! the bar still very near from EMA8 so i could have wait and get at leat 4 ticks more, it continued trending up.

In the morning at 10.57 AM i had a perfect opportunity but i was distracted and missed that trade. Anyway at 11 AM was news: ZEW economy sentiment report and its better dont to trade 5 minutes before or after the report.

No trades today, almost all day FESX was moving in ranges between S1 – S4

By mjose | Filed in Trading Journal- Los indicadores mas importantes son SMA y EMA, que se encuentran ya en Ninjatrader, para el angulo de divergencia no…

- Hola. ¿donde se pueden conseguir los indicadores que usas?